February 15, 2023 – Oslo, Norway –– The latest data from Xeneta reveals a fundamental shift in the container market, with a rapid closure of the once gaping divide between long-term and spot rates on the world’s leading trade corridors.

The bigger they are, the harder they fall

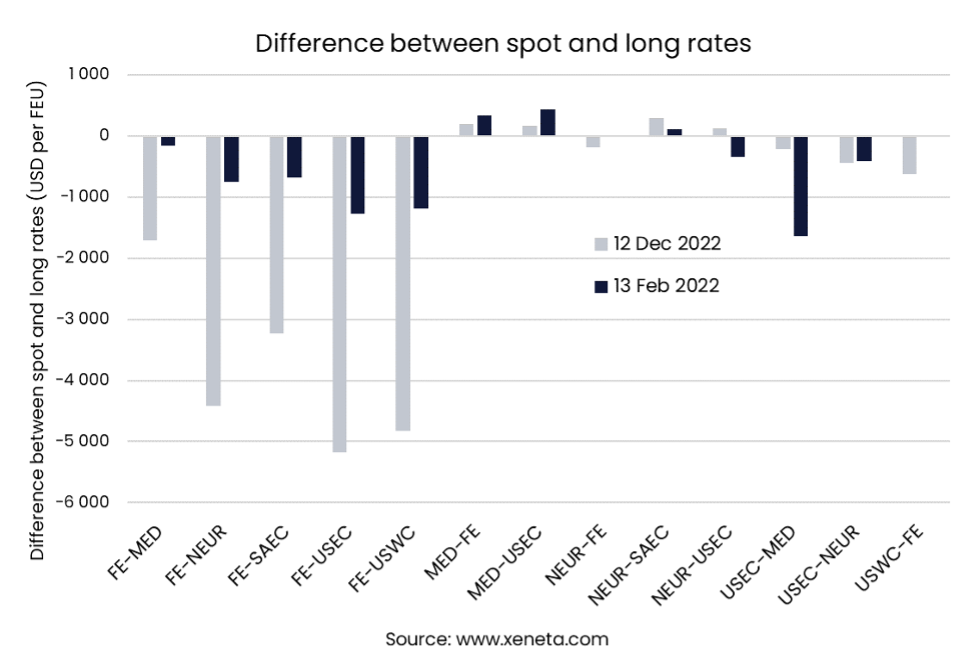

Xeneta’s crowd-sourced data paints a stark picture of developments across the five major fronthaul routes out of the Far East. As of 12 December 2022, shippers reported paying an average of USD 3 900 more per FEU on long-term contracts than the spot market. However, by 12 February, that premium had plummeted to “just” USD 810 per FEU.

The corridor with the greatest fall was the Far East to the US East Coast, where a long-term premium of USD 5 180 per FEU in mid-December collapsed to USD 1 280 over the course of the next two months.

Pressure takes toll

Sand comments: “Depressed demand, easing of the supply chain, and availability of equipment, alongside other macro-economic and geopolitical factors, undermined the strong positions of the carriers last year, with spot rates quickly falling in line with weakening fundamentals. However, long-term rates initially weathered the storm, causing striking gaps to open up between the long- and short-term markets. But that’s all changing now.”

He continues: “The ferocious competition for volumes in a declining market, set against the possibility of shippers moving to spot rates to secure far greater value, meant carrier efforts to maintain elevated long-term rates were always a long shot. In the end, market forces have proved irresistible, as evidenced by this dramatic ‘correction’ of the rates divide.”

New approaches

Sand notes that the shippers are now firmly in the ascendancy in negotiations. He expects long-term rates will “continue to fall” and says the arrival of TPM, and the signing of new contracts in the US, will be an interesting indication of things to come.

Approaches to negotiations are, he points out, “evolving in line with the ever-changing picture,” explaining: “Many shippers are looking to secure index-linked agreements to ensure they don’t miss out on future rates falls. In a recent webinar for Xeneta customers, almost a quarter of participants responded they were signing up for index-linked 12-month deals. Another one in five revealed they were shortening the length of their new long-term contracts to between three and six months to benefit from what is expected to be a continued downward trend.

“The fact they can follow these strategies clearly demonstrates their increased power at the negotiating table.”

Detailed differences

Xeneta’s data also highlights that the Far East to the Mediterranean trade is the major fronthaul with the smallest ‘rates gap’, with spot rates now averaging USD 3 120 per FEU and long-term contracts at USD 3 270 per FEU (a premium of USD 150).

On four of the smaller of Xeneta’s top 13 trades, shippers on the spot market are paying more than those signing new long-term contracts – with spot premiums of between USD 10 and USD 430 per FEU. All four are trades out of Europe, two from the Mediterranean to the Far East and the US East Coast, as well as the corridors from North Europe to the Far East and to the South American East Coast.

About Xeneta

Xeneta is the leading ocean and air freight rate benchmarking and market intelligence platform transforming the shipping and logistics industry. Xeneta’s powerful reporting and analytics platform provides liner-shipping stakeholders the data they need to understand current and historical market behavior – reporting live on market average and low/high movements for both short and long-term contracts. Xeneta’s data is comprised of over 500 million contracted container and air freight rates and covers over 170,000 global ocean trade routes and over 60,000 airport-airport connections. Xeneta is a privately held company with headquarters in Oslo, Norway and regional offices in New York and Hamburg.

To learn more, please visit www.xeneta.com.

-1.jpg)