Long-term rates just hit record highs – again! Learn what Xeneta experts have to say about the future of the ocean and air freight market amidst these recent events that can potentially impact your future negotiations with your suppliers.

Is the party almost over for container lines? | The Business Times

In the past 2 years, container freight rates have soared, and shipping lines have, at long last, been making real money. However, that has prompted a backlash from shippers and others, exemplified by the new US Ocean Shipping Reform Act of 2022 (OSRA).

Oslo-based freight-rate benchmarking and market-analytics platform Xeneta has released the figures, drawn from its Xeneta Shipping Index (XSI) Public Indices for the contract market, which crowd-sources and aggregates real-time data from the world’s leading shippers — and they suggest that rates may continue to climb.

According to Xeneta, long-term contracted ocean-freight rates, as the cost of securing container shipments, climbed by 10.1 per cent in June. Now, rates are about 170 per cent higher than at this time last year, with just 2 months of declines in the last 18 months. The analyst noted: “Despite a degree of macro-economic uncertainty clouding the horizon, all major trades saw prices moving up, with some corridors showing significant gains.”

Xeneta CEO Patrik Berglund said: “Rates developments that would have been front page news a few years ago are in danger of becoming the norm in a market environment that is historically hot. After last month’s colossal rise, we see another hike of 10 per cent, pushing cargo owners to the limits, while the carriers fill their pockets. Again, we have to question, is this sustainable? And the signs are gathering that, well, it might not be.”

Read full story here.

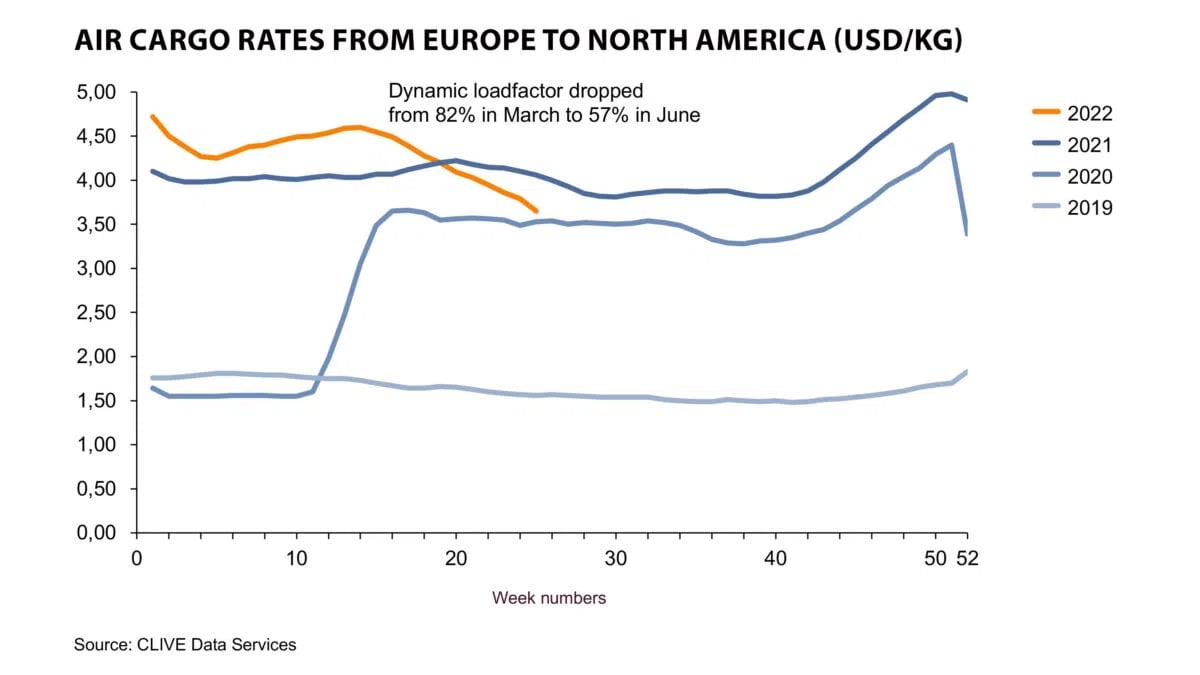

Slide in air cargo volumes, rates eases amid pent-up demand | FreightWaves

Data from IATA, research firms shows market conditions firming in what remains historically strong year. Xeneta's Airfreight market analytics firm 'Clive Data Services' reported that June global volumes fell 8% year over year, following May’s 7% decline.

The company’s Clive Data Services unit has arrangements with many carriers to capture current data from widebody passenger and all-cargo aircraft, in contrast to IATA’s lagging data from carriers. Cargo capacity increased 6% from 2021 but is still down 11% from pre-pandemic levels, it reported Wednesday.

Read full update here.

Ships get older and slower as emissions rules bite | Reuters

If shipping is the beating heart of global trade, its pulse is about to get slower. Faced with uncertainty about which fuels to use in the long term to cut greenhouse gas emissions, many shipping firms are sticking with aging fleets, but older vessels may soon have to start sailing slower to comply with new environmental rules.

While energy-saving devices go a long way to tackling emissions, ultimately, newer vessels are a better bet, said Peter Sand, chief analyst at shipping and air cargo data firm Xeneta.

"The next generation of fuel oil ships will be much more carbon efficient, they will be able to transport the same amount of cargo emitting only half of the emissions that they did over a decade ago," he said.

Read more here.

There’s a battle over inflation-linked pay adding to European port contagion | CNBC

- German labor union ver.di is calling for a yearly automatic inflation adjustment built into a renewed contract.

- The union, which represents workers at key ports where container congestion is getting worse, says the seaport companies’ representative ZDS has “rejected the principle of inflation protection in talks with the union,” though ZDS says its offer already takes inflation into account.

- Recent strikes at the German ports have slowed down trade in exports including cars, auto parts and furniture.

Read full report here.

Note: Xeneta is one of the data providers for ocean and air freight benchmarking analytics for The CNBC Supply Chain Heat Map.

OECD lowers global growth prognosis – will hit container market | ShippingWatch

Demand in the global container market is cooling, and the OECD’s new downgraded growth forecast confirms that the growth rate of the economy is declining.

“Demand in container shipping is also declining this year. We have known that for a long time. However, geopolitics and oil prices have reinforced this trend,” writes Peter Sand, chief analyst at Xeneta, in a comment to ShippingWatch.

Full update available here.

Ships get older and slower as emissions rules bite | The Economic Times

From next year, the International Maritime Organization (IMO) requires all ships to calculate their annual carbon intensity based on a vessel's emissions for the cargo it carries - and show that it is progressively coming down. While energy saving devices go a long way to tackling emissions, ultimately, newer vessels are a better bet, said Peter Sand, analyst at shipping and air cargo data firm Xeneta.

"The next generation of fuel oil ships will be much more carbon efficient, they will be able to transport the same amount of cargo emitting only half of the emissions that they did over a decade ago," he said.

Read more here.

Global cargo shortage: How iron boxes became money magnets | Yahoo Finance

The cost of shipping goods from China to Europe has increased more than six-fold, hitting record highs as a shortage of empty cargo containers and Russia’s invasion of Ukraine disrupts global trade.

The cost of shipping a 40-foot container from China to Europe has jumped from around $2000 (£1500) a year ago to more than $15,000 in January, according to the figures from shipping data and analytics company Xeneta, before correcting to $11,00 at the start of July.

Shipping costs soared as consumers unleashed pent-up savings to buy merchandise while the pandemic continued to disrupt the world’s supply chains.

“All off the sudden, people started buying a lot of cargo mid-pandemic and the problem now is that those containers are in the wrong places of the world. They are in Europe and in the US and not back in Asia,” Xeneta CEO Patrik Berglund told Yahoo Finance UK.

Full story is available here.

Want To Learn More?

Schedule a personalized demo of the Xeneta platform tailored to match your container shipping and air cargo procurement strategy.