The latest Xeneta data reveals global schedule reliability in ocean freight container shipping fell to 51.6% in January (source: Sea-intelligence), driven down by delays resulting from the Red Sea Crisis.

Falling schedule reliability is bad for all shippers, but those shipping refrigerated goods are hit particularly hard by sudden increases in transit times and uncertainty.

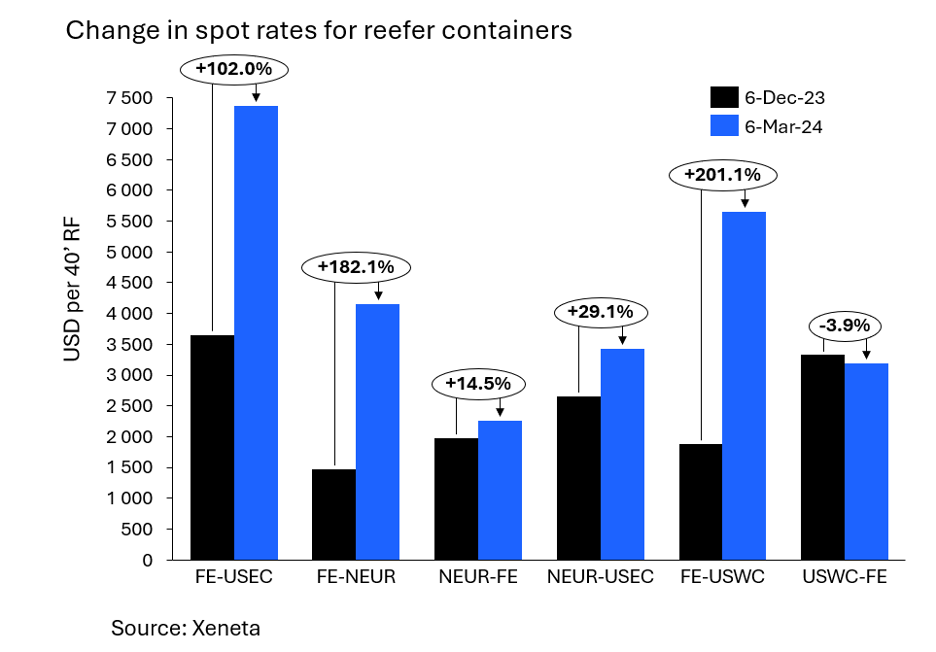

The impact on reefer rates has varied widely. Some trades have seen a doubling and even tripling of rates, while others are down compared to pre-crisis, early-December rates.

For reefer shippers, this means global averages mean very little. If they want to make the right decisions for their supply chain, they need to use the Xeneta platform to dive into trade specific data.

What the data shows

In January, the Far East to US East Coast trade had the lowest schedule reliability, with only 33.8% of ships arriving on time. The two thirds that arrived late did so by an average of just under six days.

On top of these delays, shippers have seen a doubling in the cost of transporting a reefer container from the Far East to the US East Coast since 1 December 2023.

On 6 March the average spot rate for a 40’ reefer container was USD 7370. The spread between reefer and dry containers on this trade has also risen to USD 1700 per FEU, which is USD 550 per FEU higher than three months ago.

An even bigger increase in spot rates for reefer containers can be found from the Far East to North Europe. Spot rates for a 40’ reefer on this trade rose to their highest level since October 2022 at USD 4890 per FEU in mid-January, though have since fallen to USD 4160.

This leaves reefer spot rates up by 182.1% from early December, compared to a 162.9% increase in rates for dry containers.

Reefer rates have risen far less on backhauls to the Far East

Unlike with dry containers, there are more reefer containers shipped on the backhaul from Europe to the Far East than the reverse. In 2023, there were 1.8 times as many loaded reefer containers going from Europe to the Far East than on the fronthaul.

Despite this, reefer rates into the Far East are still around half the level of those from the Far East to Northern Europe, averaging USD 2260 per 40’ on 6 March. This is just 14.5% higher than 1 December and also a much smaller increase than the 128.6% jump in spot rates for standard 40’ containers on this trade.

Not all lanes are behaving the same way

From North Europe into the US East Coast, spot rate increases have been more uniform between standard and reefer containers than from North Europe to the Far East. Spot rates for reefer containers on this trade have risen 29.1% over the past three months, compared to a 49.4% increase for standard FEUs.

This more muted increase on the transatlantic in comparison to other fronthaul trades could be explained by it not being a trade directly impacted by the Red Sea Crisis. However, there are other trades which are also not impacted by the Red Sea and do not follow this logic.

Reefer spot rates from the Far East to the US West Coast have risen to USD 5650 per 40’ box, the highest they have been since Q3 2022. This increase leaves the spread between reefer and dry rates on this trade at USD 1330 per 40’ container.

The backhaul trade across the Pacific has, in contrast to many other backhaul trades, not moved a lot over the past three months. In fact, reefer rates have fallen by 3.9% over the past three months, leaving them at USD 3 200 per 40’ reefer.

Again, this underlines the importance of using the Xeneta platform to understand the data on a trade-by-trade basis.

Long term rate spread widens from East Coast South America to North Europe

Another important reefer trade which doesn’t use the Panama Canal, but which has still seen an impact in rates, is from East Coast South America to North Europe.

Here, the spread between long term rates for reefer and standard containers has widened from USD 500 per 40’ container in October 2023 to now stand at USD 2200.

This increase in spread over the past six months has been driven by a 25.7% increase in reefer long term rates, while rates for dry containers have fallen by 30.8% over the same period.

As the ocean freight shipping network continues to adapt to the situation in the Red Sea, Xeneta will provide further updates in the impact on reefer rates and reliability across all the world’s major trades during 2024.