In this week's container rate update, we will mix it up a bit and focus on the tanker container market. It deserves some attention as well. Just like its dry container cousin, the tanker containers have been impacted by post-pandemic disruption around the world, congestion in ports, and record low schedule reliability. Check out this brief overview of tanker container rate evolution.

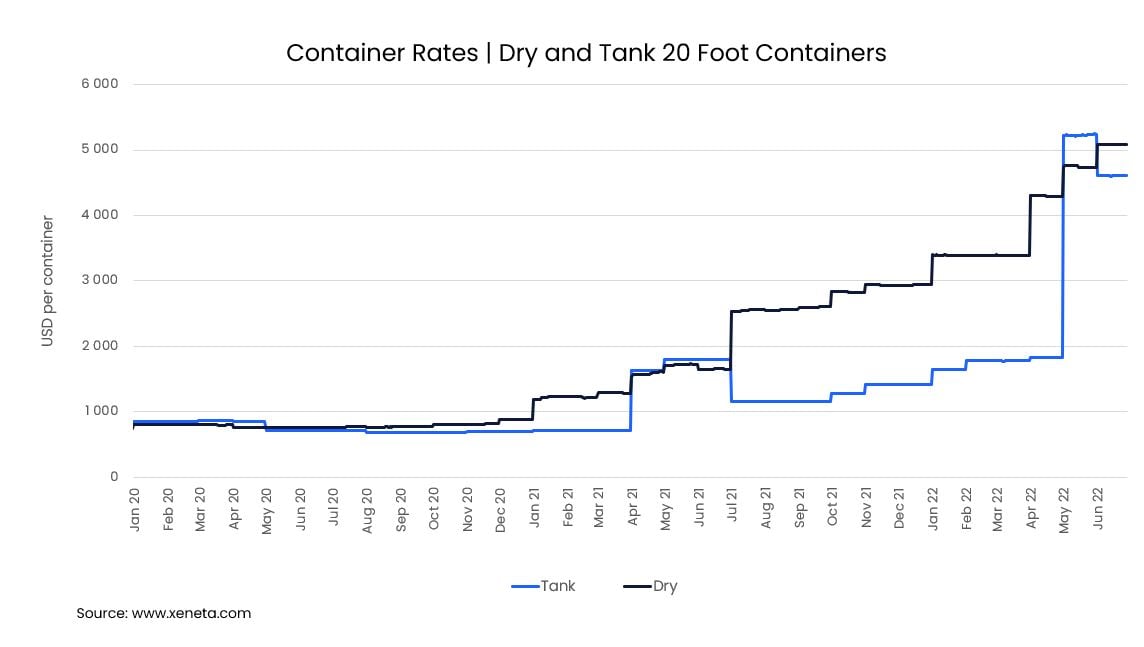

Over the past year on the Far East to North Europe trade, long-term tanker container freight rates for a 20-footer have increased at a slower pace than their 20-foot dry counterparts. Rates for tanker containers have increased by 156% compared to the end June 2021, rising to USD 4 611 following a large jump in May as new long-term contracts started. Rates for dry containers have increased by 208% to USD 5 083 per TEU, with a more steady increase over the past year.

At its highest, the difference between the dry and tanker container rates peaked at USD 2 500 in mid-April 2022. In May, as the market started to normalize somewhat again, we then saw that tanker container rates were only briefly above their dry container counterpart. Interestingly, in a normal market, rates for the two types of containers hardly differed. This is further evidenced by the fact that on January 1, 2020, there was less than USD 50 per container difference between dry and tanker.

The opposite is true on the backhaul trade where tanker container rates are higher than the standard dry TEUs, though not by much: USD 150. As on many other trades, the backhaul long-term rates from North Europe to the Far East have risen by much less than those on the fronthaul, up by 49% to USD 1 150 per container.

The Far East and North Europe trade contract market rate increases are very similar to those seen on the North Europe to the US East Coast trade. These have risen to USD 4 100, a 124% increase compared to a year ago, but still lower than the average long-term rate for standard dry TEUs (USD 5 230).

Just as has been the case for standard dry containers, the market for tank containers has been impacted by post-pandemic disruption around the world, congestion in ports and record low schedule reliability. On top of these, tank containers also require specialized cleaning and drivers, adding to the problems faced by shippers of standard dry containers.

Note:

The Weekly Container Rates blog analysis is derived directly from the Xeneta platform, and in some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures, however, they differ in their aggregation methodologies.

Want to learn more?

The container market is no walk in the park. You need to have the latest rate and supply data to be able to plan and execute your freight procurement strategy quickly. Xeneta's real-time and on-demand data is here to help you answer, "Am I paying the right freight rate?" Sign up for our weekly 15-minute live group demo below and see Xeneta for yourself.