Xeneta team wishes you a very happy new year! Before we dive into current market developments in 2023, this week's blog looks back at the spot and long-term rates development on the three biggest fronthaul and backhaul trade lanes.

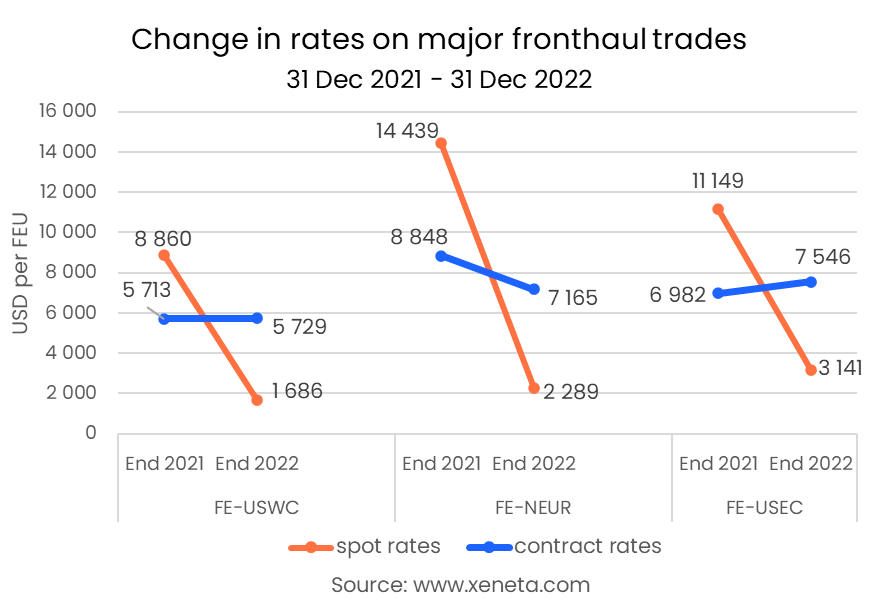

The three largest inter-regional fronthaul trades are all out of the Far East, one to each of the US coasts and one to North Europe. Across the three trades, the spot rate fell by an average of 79.3% from 31 December 2021 to 31 December 2022. The biggest drops in both the absolute value as well as a share of the total rate were seen on the Far East to North Europe trade (-84.1%).

The smallest percentage drop in spot rates came from the Far East to the US East Coast (-71.8%). However, due to the higher total rate, in dollar terms, it saw a smaller drop than rates into the US West Coast.

Across all three of these main fronthaul trades, the difference between spot and contract rates switched. At the end of 2021, long-term rates on these trades were at USD 4 300 per FEU, lower than spot rates on average, to be USD 4 450 per FEU more expensive. At the end of 2022, the Far East to North Europe trade had the largest spread, USD 4 900 per FEU, between spot and contract rates.

Compared to December 2021, only long-term rates to North Europe fell (down by 19.0%). Contract rates into the US from the Far East were slightly higher in December 2022 (+0.3% to the West Coast and +8.1% to the East Coast). Part of this is due to the different seasonality of contracting on these trades.

Long-term rates from the Far East to the US East and West Coasts peaked in April 2022 and fell by 32.4% and 36.0% between then and the end of 2022, respectively.

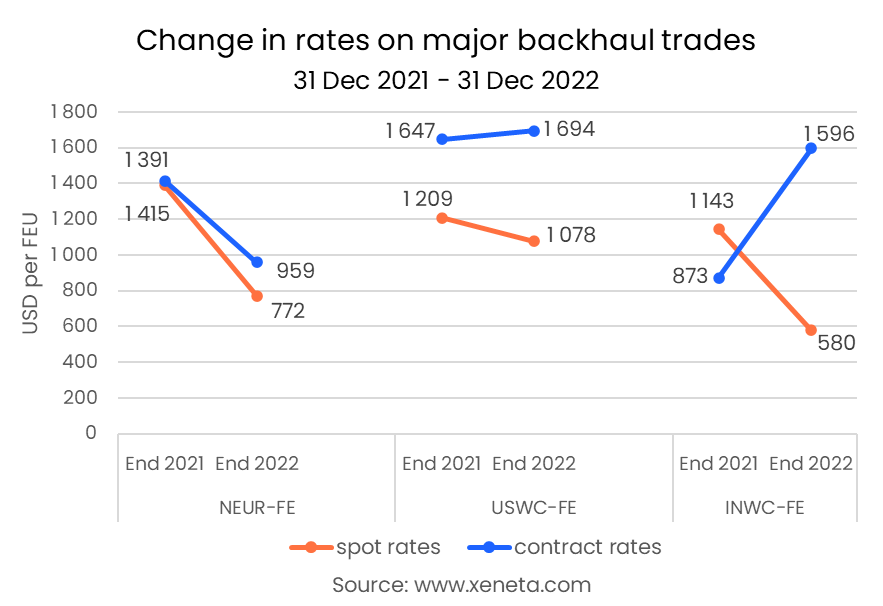

The three largest inter-regional backhaul trades witnessed mixed developments. The long-term rates on one of the three trades almost doubled over the course of 2022, while spot rates were reduced to half.

From the Indian West Coast to the Far East, spot rates fell by 49.3% from 31 December 2021 to 31 December 2022, while contract rates rose by 82.8% over the same period. This led the spread in rates to go from spot rates being USD 270 per FEU more expensive to USD 1 000 per FEU cheaper at the end of the year.

Spot and contract rates also move in opposite directions from the US West Coast to the Far East, though at a much lower scale. Here spot rates fell by 10.8%, while contract rates were up by 3.9%.

In contrast to the other backhaul trades, the world's busiest backhaul trade, North Europe to the Far East, followed the development on the fronthaul. Both spot and long-term rates fell in 2022's 12 months, down by 44.5% and 32.2%, respectively.

Note:

The 'Weekly Container Rates Update' blog analysis is derived directly from the Xeneta platform. In some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures; however, they differ in their aggregation methodologies.

Want to learn more?

Sign up today for our upcoming monthly State of the Market Webinar to stay on top of the latest market developments and learn how changing market conditions might affect your contract negotiations.

.png)