Global ocean freight container shipping has been impacted by numerous geopolitical and environmental incidents in recent times, and the list got longer over the weekend following an escalation in conflict in the Middle East.

In the early hours of Saturday, 13 April, Iranian military forces seized the 14,952 TEU containership MSC Aries while en route to India from the Abu Dhabi port of Mina Khalifa.

The incident took place near to the Strait of Hormuz, the gateway to the Arabian Gulf, raising concerns over the safety of ocean freight supply chains in the region.

While Mina Khalifa is a main hub for containerized cargo, the Arabian Gulf is also home to Jebel Ali in Dubai, which accounts for 4.6% of the world’s containerized ocean freight volume.

In “Lloyd’s List One Hundred Ports 2022”, Abu Dhabi ranks 57th, with a throughput of 3.4m TEU (20ft container) in 2021, while Dubai ranks 11th with a throughput of 13.7m TEU per annum.

Ripple effects from Rea Sea / Gulf of Aden tensions

Xeneta data shows that, not only is Jebel Ali one of the world’s most important ports, it is also sensitive to geopolitical unrest and conflict.

Looking at a key trade from Shanghai to Jebel Ali, average spot rates increased by 87% as 2023 turned into 2024, reaching USD 3132 per FEU (40ft container). This coincided with increasing tension and outbreak of conflict in the Red Sea, which saw ocean freight container services being diverted away from the region.

Rates on this trade continued to climb, reaching USD 3 300 by 15 January before falling back to USD 2 300 per FEU by the middle of February as ocean freight services began to normalize to Red Sea diversions.

However, the spot market has once again reacted to the recent growing political tensions, increasing by 32% between 22 March and 17 April to reach USD 2 849 per FEU.

A potential chokepoint for ocean freight shipping

In the days following the seizure of MSC Aries, container ships have continued to sail through the Strait of Hormuz, once again demonstrating the resilience of ocean freight container services.

The MSC Aries incident on Saturday morning was a targeted attack by Iran against Israeli interests rather than a random hijacking. This is unlike the situation in the Red Sea where almost any ship is a target for Houthi militia and perhaps why ships are continuing to sail through the Strait of Hormuz.

That being said, Hyundai Glovis has stated it is assessing its shipping routes to enhance safety following escalation in the region and is considering the use of transshipment points instead of direct stops at Arabian Gulf ports.

This does not appear to be the start of sustained and indiscriminate attacks against ships in the region, but it would be unwise to predict the trajectory of such a politically volatile situation and risks to supply chains must be considered.

To put the significance of the Strait of Hormuz into perspective and its potential to become a chokepoint for ocean container shipping we must look at cargo volumes transiting the region.

In 2023 a total of 5.5m TEU were inbound (56% of total Middle East imports), whereas 2.9m TEU were exported through the Strait of Hormuz to destinations across the globe (Source: Container Trades Statistics).

The supply chains in Arabian Gulf nations are far more complex however, with a further potential impact to be found in the land bridge connecting the container ports of Jebel Ali in UAE and Dammam and Jubail in Saudi Arabia with the Port of Jeddah in the Red Sea.

This land bridge is seen as a contingency route by carriers, such as Hapag-Lloyd, to avoid sailing through the Red Sea and Gulf of Aden in order to reach the Suez Canal. But if maritime corridors through the Strait of Hormuz are compromised this may no longer be an option.

Another potential impact of disruption to ocean freight corridors through the Strait of Hormuz are sea-air solutions, which has been another way shippers have been mitigating the impact of disruption in the Red Sea.

Cargo has been arriving in the Arabian Gulf from the Far East via ocean freight container services before being switched to air freight services for onward transportation to Europe and North America, mainly out of Dubai airport.

Again, if containers are unable to reach ports in the Arabian Gulf this sea-air option will no longer be viable for shippers.

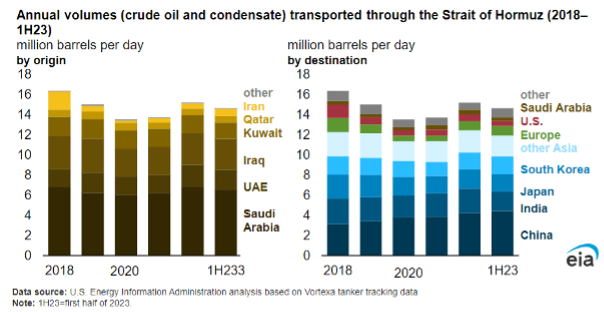

Oil trading through the Strait of Hormuz matters too

With fuel oil being the single biggest voyage cost in maritime transport, there is another clear risk posed by escalation of conflict in the Middle East.

Following the seizure of the MSC Aries many commentators feared a spike in Brent crude oil prices but this has not materialized. In fact, the cost of a barrel slid slightly since Saturday after it had previously moved from USD 87 at the start of April to reach USD 91 on 5 April. Further decline on 17 April does not reflect a sudden evaporation of risk, but more demonstrates that the oil price regularly moves in mysterious ways.

Initially this means bunker fuel oil prices should not go up either. However, oil trading and prices are a risk during times of geopolitical tension and shippers will be monitoring the Bunker Adjustment Factor closely in the coming weeks.

Escalation of conflict in the Middle East last weekend was just the latest major geopolitical incident to impact supply chains in recent times. It is vital to stay updated on the data and market intelligence in order to make evidence-based decisions in the aftermath of these global events.

Join Peter Sand, Xeneta Chief Analyst, and Emily Stausbøll, Xeneta Market Analyst, in our next live webinar as they discuss the current market disruptions – as well as what could be around the corner in the remainder of 2024.

Register for the webinar for free here.