A lack of seasonal rainfall in the Panama Canal region between February and April could leave carriers high and dry, with further draft restrictions set to take hold. Precipitation during the period was less than half of normal levels, with some welcome rainfall arriving in late May.

With El Niño forecast to return in 2023/2024, making the region warmer and dryer, the pressure is well and truly on for this vital link between the Pacific and Atlantic basins. The North Europe to South America West Coast corridor, dependent on the Panama Canal, has seen turbulent fluctuations during the pandemic years, impacting shipping volumes and freight rates.

Feeling the draft

The Panama Canal Authority has already lowered draft restrictions several times in 2023, with the most recent announcement, on 29 May, only postponing the next cut by two weeks. Every cut means less cargo can be carried by ships transiting the Neopanamax locks.

Inaugurated in June 2016, the Neopanamax locks made it possible for containerships more than double the size of earlier vessels to bring cargo from Asia to the US East Coast, Europe to the South America West Coast, the US Gulf Coast to the Far East, and across many more inter-regional trades. With a normal draft maximum of 50 feet (15.24m), the current permitted draft of 44.5 feet (13.56m) is already impacting business. The new draft limit of 43.5 feet, valid from June 25, will take this, quite literally, to a new level.

With a total of 285 Neopanamax ships transiting the Panama Canal in April alone, half of which were containerships, each incremental cut has significant volume ramifications.

Down but not out

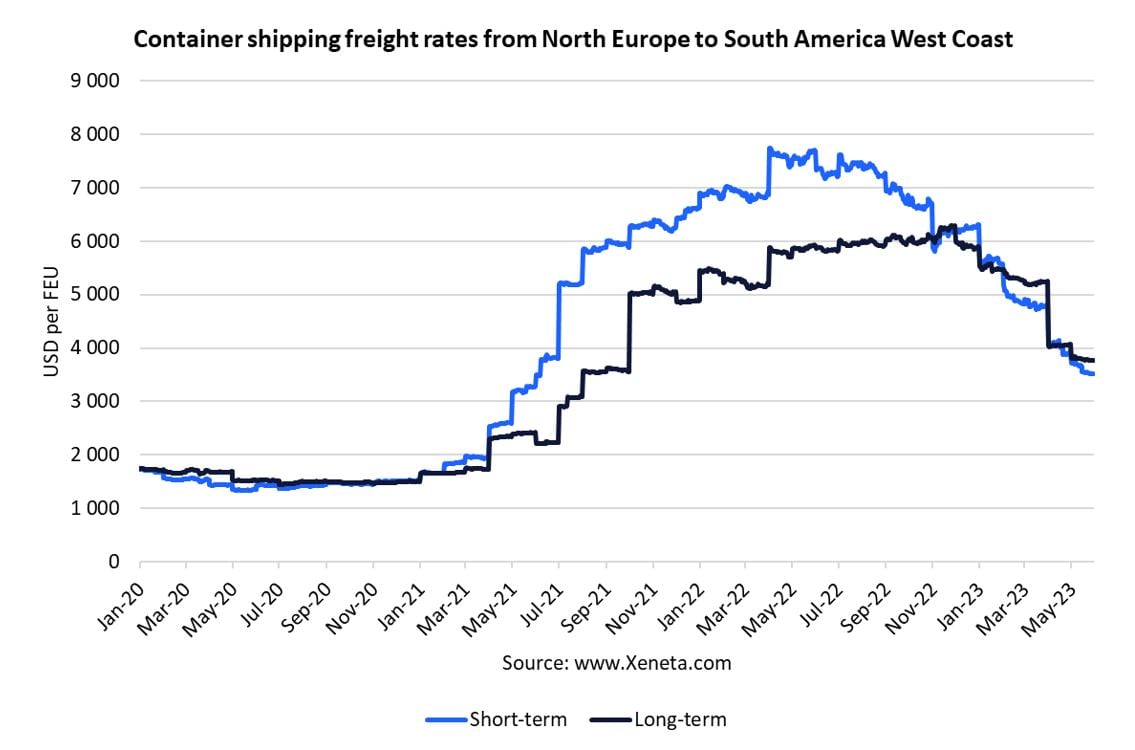

A trade that has really experienced the ‘high and low tides’ during the Covid-years – and one that relies on an efficient Panama Canal transit - is the North Europe to South America West Coast corridor. Volatility has been the order of the day here, with everything from shipped volumes to short-term and long-term contract freight rate levels in a state of near-constant flux.

Short-term rates on the trade peaked at USD 7 707 per FEU exactly one year ago and have since fallen to USD 3 500 per FEU. Although the 55% drop is welcome news to shippers, it’s somewhat cold comfort when the rate remains some 2 000 dollars higher than the 2020 average.

Short-term rates on the trade peaked at USD 7 707 per FEU exactly one year ago and have since fallen to USD 3 500 per FEU. Although the 55% drop is welcome news to shippers, it’s somewhat cold comfort when the rate remains some 2 000 dollars higher than the 2020 average.

Delayed developments

Xeneta data shows the same is true for long-term rates. Prices have fallen by around a third since the peak levels seen from April through to November 2022. However, long-term contracts signed within the most recent three-month period are still just shy of USD 3 800 per FEU. In this respect, the decline in rates on this trade is somewhat detached from the trend experienced by larger trades, which have fallen further and more dramatically.

Why is this? Every year around 250,000 TEU is shipped from North Europe to the South America West Coast (source: CTS). It may just be a fact of life that container rate movements trickle down slowly from the largest trade lanes to the smaller ones, with a delay in developments as carriers update and revise their global container shipping networks to adapt to the ‘next normal’ market conditions.

Size matters

As ships become ever larger, and carriers reap economies of scale by deploying them across trades, the ports that can handle more container lifts per call, with optimal efficiency, find favor. This well-established trend for imports from the Far East on the South American East Coast is now developing for containerized goods coming from North Europe to the continent’s West Coast.

While the nature of the trend is the same, the spread between spot container rates into secondary (sub) and primary (main) container ports is more volatile on the West Coast, jumping to USD 1 300 per FEU in November 2022. At this point, the corrective downfall was most pronounced into the primary ports. Xeneta’s data indicates that the normal spread is USD 300 per FEU. In May 2023, the spread has hovered at around USD 400 per FEU, clearly indicating that a normalized market remains some way off.

Small changes, big impact?

With the ongoing tightening of draft restrictions in the Panama Canal, smaller ships may return to favor with the carriers, as they find themselves unable to utilize the full capacity of larger vessels.

This puts upward pressure on short-term market rates and may prompt shippers to alter their supply chains if port calls also change in line with the ship sizes.

Watch this space for more insights on this dynamic trade, and much, much more.

Note:

The 'Weekly Container Rates Update' blog analysis is derived directly from the Xeneta platform. In some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures; however, they differ in their aggregation methodologies.

Want to learn more?

Are you looking for visibility into the volatile container shipping market? Find out how simple it is to get the insights and intelligence you need to make sure you, your team and your business quickly adapt to changing market conditions.

Know instantly how your freight rates compare against the market, justify your transportation costs, prepare for your tender period and report on your success with one powerful easy-to-use platform. Get a demo now!