Welcome to the ocean freight shipping casino… place your bets please!

The industry is deep into tender season and Xeneta analysts are diving into the latest data to bring you the first indications of where the market is headed in 2024… and there is an intriguing story emerging in the rates battle between carriers and freight forwarders.

Xeneta’s tender analysis uses data from eight trades to benchmark the new 2024 rates. For clarity, ‘new 2024 rate’ is defined as contracts which have been signed or tabled since November with a minimum 12 month duration.

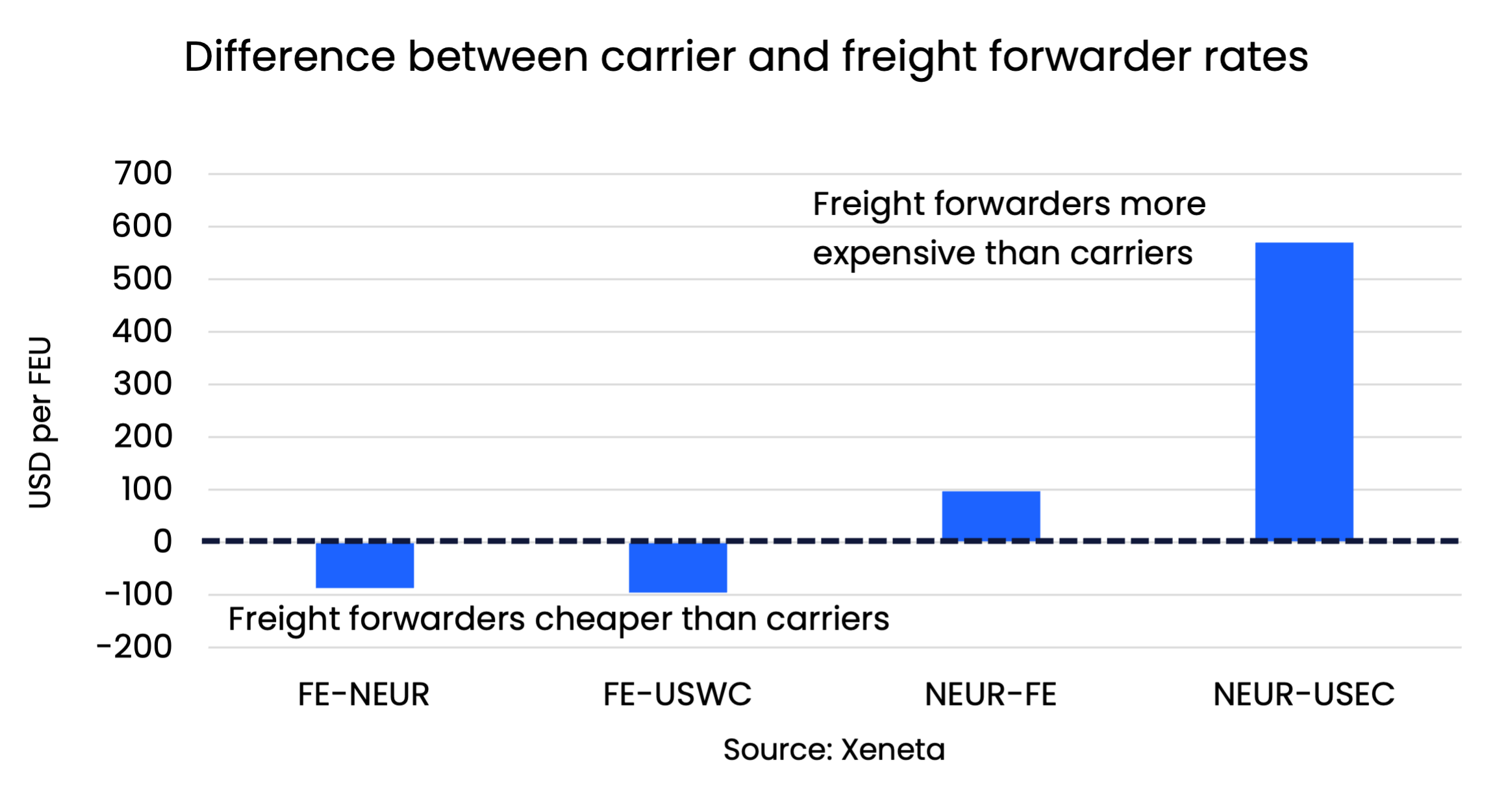

First, let’s take a look at the spread of long term rates from carriers and freight forwarders which entered validity in 2023, as shown in the table below.

On major trades out of the Far East into North Europe and US West Coast during 2023 carriers were cheaper than freight forwarders on long term rates. However, the latest Xeneta analysis reveals freight forwarders are now offering cheaper rates than carriers.

For example, between The Far East and North Europe, 2024 rates from carriers average USD 1 500 per FEU, which is USD 300 higher than rates being offered by freight forwarders.

What does this mean? Well, it depends on the freight buying strategy of each freight forwarder.

If a freight forwarder agrees a long term contract for 2024 with a shipper but decides to play on the spot market, they are betting against rates increasing above the contracted rate during 2024.

If the freight forwarder decides to buy freight from a carrier up front, then they are locked into a rate and are hedging their bets against prices falling below contracted rates during 2024.

As Clint Eastwood once famously said, ‘do you feel lucky?’.

Emily Stausbøll, Xeneta Market Analyst, believes freight forwarders and shippers alike have some big choices to make.

She said: “We should be clear that shippers choose freight forwarders for a number of reasons such as the wider services they offer. But rates are clearly a major factor in the decision-making process.

“2024 has the potential to be a tricky year for freight forwarders. On one hand they have the carriers who want their volumes, and on the other hand they have shippers who are demanding lower and lower prices in a highly competitive market.

“They are going to have to make careful decisions – or you could call it a gamble – where to position their rates for 2024. Freight forwarders who choose to continue playing on the spot market are at risk of a pick-up in the market.

“Shippers choosing how to allocate their volumes for next year are facing a similar dilemma. We have seen over the past few years how some shippers, who have flexibility in their procurement decisions, switch at least some of their volumes onto the spot market. That may not be the best play in 2024.”

The Transatlantic stands out from the other trades, as new long term rates offered by freight forwarders for 2024 are higher than those offered by carriers – a reversal of 2023.

That the transatlantic trade is the odd one out when it comes to new rates for 2024 sheds some light on what’s driving the spread between carriers and freight forwarders.

The lower rates offered by carriers suggests they are holding out little hope for a change in the supply/demand balance on this trade – unlike other major trades where they are clearly managing capacity in an attempt to increase rates.

On the other hand, freight forwarders are offering lower rates, which suggests they either already have, or believe they will be able to, procure space on board ships at a lower prices than the rates they are offering.

Again, do you feel lucky?

It would be doing a disservice to freight forwarders to suggest this is merely a game of chance and clearly there are calculated risks being taken. Perhaps they believe they can buy enough ‘cheap’ space in bulk on the long term market or that the spot market will stay low enough to protect their margins.

Once negotiations are finished and contracts are signed for 2024 we will know where all the chips have been placed.

It’s tough the beat the house, but using Xeneta benchmarking data to understand where the market is heading in 2024 means you are more likely to be leaving the casino up rather than down.

This is yet another way Xeneta is bringing transparency to the opaque shipping market. If you are a shipper or freight forwarder entering negotiations, or yet to finalize new 2024 contracts, the Xeneta platform will illuminate the market, allowing you to understand where your business is positioned.

If you have agreed your new contracts, it is vital you are able to continually benchmark against the market throughout 2024 to ensure you are receiving maximum value for money.

To help you do this, Xeneta customers have access to our leading data benchmarking and intelligence platform, as well as exclusive insights including the full 2024 Tender Analysis Report from our team of industry experts located in the Specialized Market Reports in the IQ Hub (linked in platform). Reach out to your Customer Success Manager directly with any questions.

%201.png)