Love is, quite literally, in the air as North America gears up for Valentine’s Day on 14 February through the import of fresh-cut flowers from Latin America.

Let’s take a look at how the air freight market on this important corridor is shaping up as it enters the first peak season of the year.

The largest exporters of fresh-cut flowers into the US from Latin America are Colombia and Ecuador, with Miami serving as the main gateway for onward distribution across the North America.

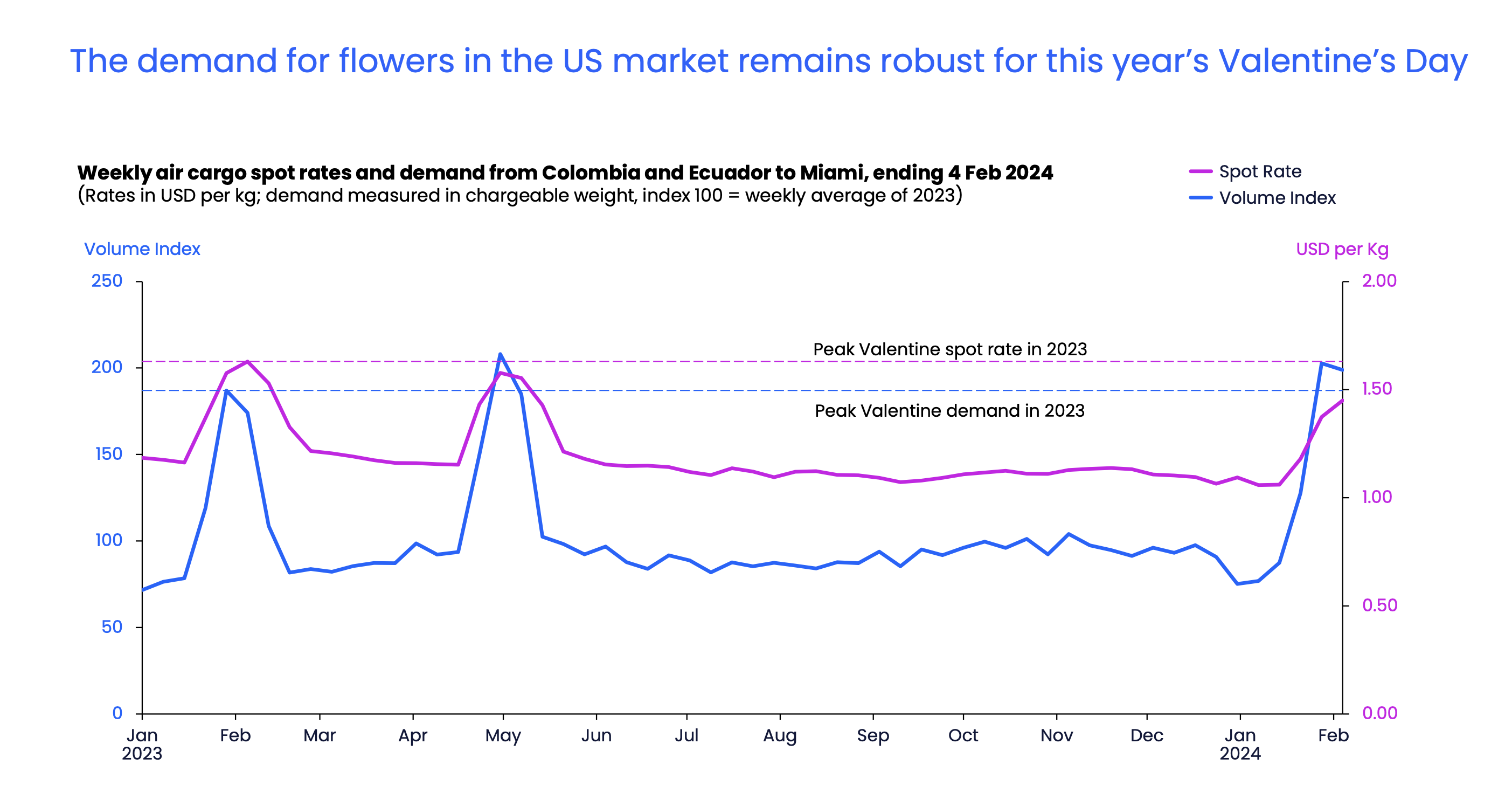

In the week ending 4 February the air cargo spot rate from Colombia and Ecuador to Miami increased by 37% to USD 1.45 per kg compared to three weeks prior, just before the start of the peak season.

Despite carriers increasing capacity through additional flights, it has not been enough to keep pace with the surge in demand, as measured by air cargo chargeable weight, which soared a remarkable 128% in the three weeks ending on 4 February. Capacity increased by 81% in the same period.

The peak season surge saw the dynamic load factor, which is measured through the volume and weight of cargo flown against available capacity, remain very high on this corridor at 90% for the week ending 4 February.

Flower power boosts volumes

Despite interest rates remaining elevated in the US, the buying power of flowers has reached new heights this year, with air cargo volumes from Colombia and Ecuador to Miami increasing by almost 10% between 15 January and 4 February compared to the same three-week period in 2023.

In 2023, volumes increased by only 3% compared to the corresponding period in 2022.

Despite this increase in demand, carrier revenues are still hard-fought.

While the air cargo spot rate from Colombia and Ecuador to Miami in the week ending 4 February was 14% above the pre-pandemic levels of 2019, they were 11% lower than the corresponding week in 2023.

The decline in jet fuel prices partially contributes to the decrease in cargo spot rates. The average spot price for US Gulf Coast kerosene-type jet fuel in the week ending 26 January was USD 2.65 per gallon, a 31% decrease from the same period in 2023.

Nonetheless, the strong demand for flowers has still seen overall carrier revenues on the Colombia and Ecuador to Miami corridors for the three weeks ending 4 February remain on par with the corresponding weeks in 2023. This is in contrast to the negative year-on-year revenue growth (-1%) experienced in the Valentine’s Day peak season of 2023, which had followed an impressive 31% growth in 2022.

Demand could blossom further for Mother’s Day

Valentine’s Day is only the first peak season of the year for fresh-cut flowers on this corridor, with Mother’s Day in early May being the next period of traditionally higher demand. If the momentum the market has witnessed in recent weeks continues, we could see revenues for Mother’s Day 2024 being slightly higher than the Valentine’s Day peak season this year and Mother’s Day 2023.

This is based on the growth in US consumer spending, which was a primary factor in the increase of real GDP in the US during Q4 2023, supported by a strong labor market.

Xeneta will keep a close eye on this trade and provide a further update in the weeks leading up to Mother’s Day.

In the meantime, make sure you keep up to date on the movements across all the world’s major air and ocean freight shipping markets on the Xeneta platform.

Want to Learn More?

Watch the latest episode of our monthly State of the Market Webinar for air freight rates to see where you stand in the volatile markets. If you have any questions, please send them to info@xeneta.com.