During Covid, freight forwarders faced additional pressure to meet their customers' fluctuating expectations. As the market started to climb, they were also faced with the challenge of maintaining their margins.

Now, as the rates are falling, shippers are back in the driver’s seat. Logistics service providers will again have to up their game in order to retain their customers by helping them manage their time and risk effectively.

At the Xeneta Summit, Scott Irvine, Xeneta's Vice President of Logistics Service Providers, and Stanley Aïzenstark, VP of XSI-C, Indices & Markets, highlighted how forwarders could utilize the right data to acquire and retain their customers amidst turbulent markets.

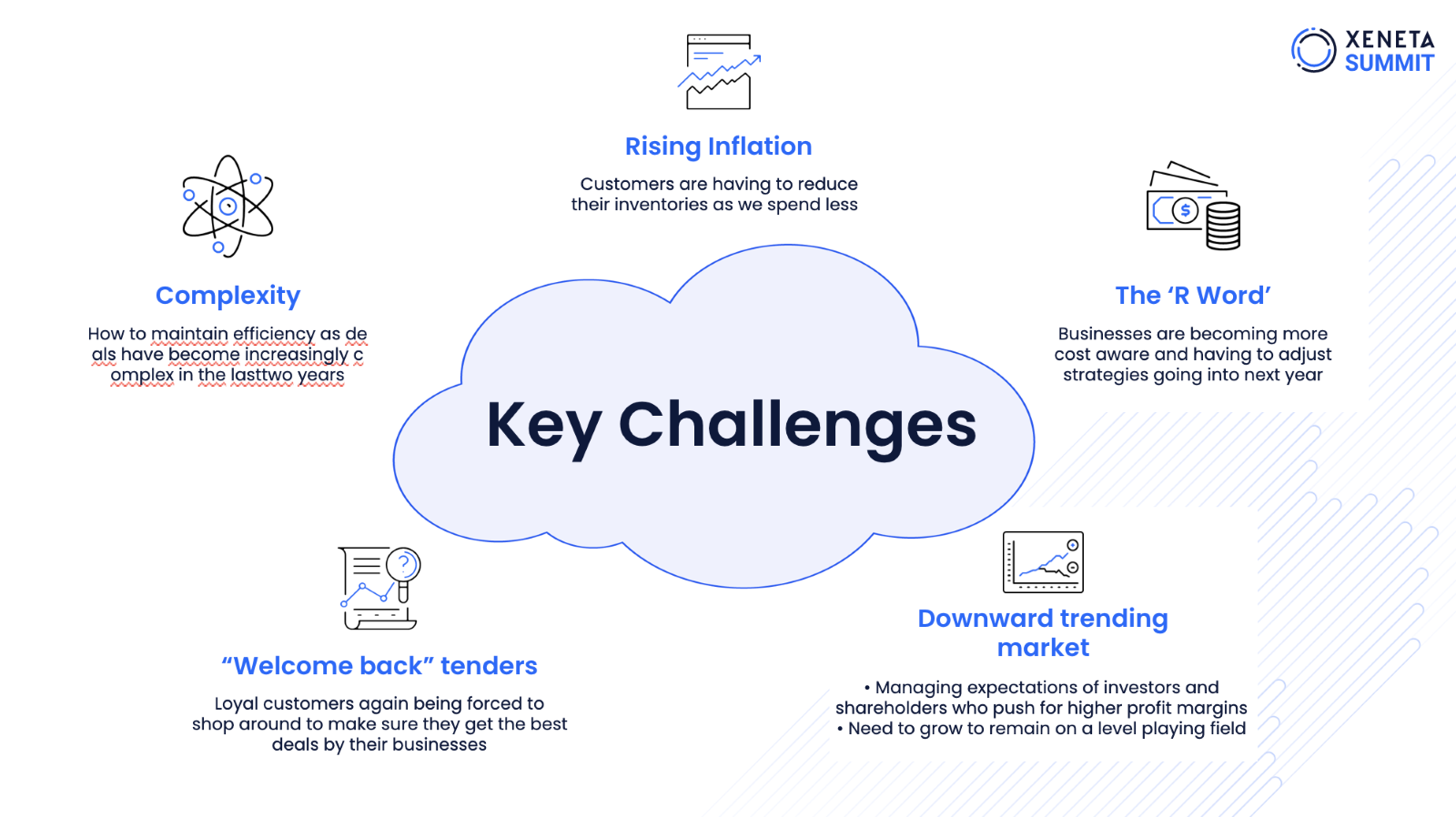

2023 comes with a set of complex challenges. We've got rising inflation costs and a cost-of-living crisis in certain parts of the world. Revenue targets are constantly shadowing all business strategies as everybody's now looking at budgets.

We’re seeing a downward trend in the market, which is good and bad. It might level the playing field for forwarders of all sizes. But it’ll also challenge them to efficiently manage the expectations of investors, owners and shareholders, as the profit margins will not remain the same as last year's highs.

And as the market drops, tenders are coming back. Forwarders know customers will be shopping around to get the best deal. This will be one of the key challenges going forward for logistics service providers (LSP) due to the added complexity of discussions, such as multi-year or index deals, which are here to stay even in 2023.

Where there is complexity, there is opportunity.

This year, we will see an increase in the number of businesses prioritizing strong digital strategies and automation. Digitalization will help them keep their costs down and improve the quote-to-win ratio. But how can you stand out if everyone is enforcing the same strategies?

Scott highlights the opportunity by emphasizing the value of data, "Using the data to know your position in the market will give you a competitive advantage and help you gain higher margins."

Most procurement professionals think they don’t need data as they know their power lanes better than anyone. However, experts suggest that most margins or profits are realized in the middle and tail range.

There are a lot of conversations about data, but using the right market rate data from a neutral source can enable you to build trust with your customers.

The level of service will be a key differentiator.

It might be an unpopular opinion, but being transparent with your customers about their position in the market will build trust and encourage them to avoid more tenders. With everyone having access to similar prices, logistics providers will have to offer better service. This will be especially critical for a customer with lower volumes as they need to deliver their cargo at the right time.

In a downward-trending market, we will soon witness disruption as carriers take out capacity to avoid running empty ships.

In this case, forward allocation will be a critical strategy. But you’ll need to stay on top of any upcoming blank sailings to help your customers avoid them.

As the rates start to stabilize and go lower, emissions data will become more critical to driving the right agenda. Forwarders will have to find new ways to find new value for customers, including quality of services, upstream management, or new markets.

Since the pandemic, we have seen a shift in how customers view their relationship with LSP. Accepting this change will be essential to surviving the next 20 years as a forwarder.

What's next?

Based on his conversations with Xeneta customers, Stanley said most Xeneta customers are asking for Index-Linked contracting based on Xeneta's XSI data.

"In an environment where rates are going down, they would like the exposure to lowered rates with the benefits of a service contract," he added.

But what is XSI-indexed contracting? Index-linked container contracts are liquid and widely available. They're in great demand. Pre-covid, almost 10% of the market contracted using indices. However, since Covid, the level has risen to 33%. In an indexing continuum contract, customers can manage the price risk.

Swaps and options are emerging in the market as risk management and budgeting tools. Derivatives also offer flexibility and reliability to the customers as they're typically based on firm products. These can be a good way to acquire and retain your customers, partly because they are long-term in nature. The average index-linked container contract can range from three to five years.

For the customer, it's an obvious risk-managing product. They prefer to evaluate risk levels they are willing to accept and define their limits. For forwarders, it helps protect their margins. Until recently, back-to-back index contracts were not available, but carriers are again bringing these back to the discussions.

Top BCOs are writing XSI-based Ocean Container Freight Derivatives (OCFDs). Top freight forwarders have been writing XSI-based OCFDs for a while, and carriers have opted for it in the last 18 months by aggressively promoting index-linked container contracts.

To lock in the revenues for the next two years and possibly longer, forwarders can't afford to have a long-term contract that isn't indexed as the adoption rate rose by 25%. Maersk also recently said that 33% of their contracting is now indexed.

A typical index contract is divided into three months and works well enough in low volatility. But once the Index separates from the contract price, the contract starts to feel stressed.

A better solution is to use daily indices, such as XSI, which can be used for short-term or long-term or with a monthly adjustment period.

With barely a month lag, the index price and the contract price are usually in better sync. It keeps both sides of the contract happy and enables people to manage their price risk more effectively. Customers now realize that it might be more effective to deal with price risk management outside of the Index Linked contract, with swaps and options based against indices.

The popular benefit of the swap is that they are capital efficient. Cash is not exchanged at the beginning. The cash is settled at the end if there's a difference. They are customizable and provide the shippers with budget ability. They can lock in rates without worrying about renegotiations or future surprises.

For example, when indexing against our platform, you can pick your origin-destination pairs from 150,000 port pairs, even at the regional level. (Xeneta experts encourage customers to go to the regional level to have more data.) As contract durations are flexible and fully customizable, you can choose either monthly or quarterly. Volume and rates can be negotiated between all parties.

Options are also a great tool to budget for uncertain demand - be it seasonality or possible mediation in unforeseen events. Customers can plan and budget for uncertain demand. They're capital efficient as the option buyer can choose how much money you would want to spend on insurance. Options also provide an effective tool for volume and rate risk management, and they're flexible. They protect the buyer from adverse risk while allowing them to benefit from favorable events.

But all these benefits rely on a good index.

For example, Xeneta publishes 30 high-quality global trade lanes. (60, including short and long-term rates). Each of these trades has 36 months of consistently deep daily data available.

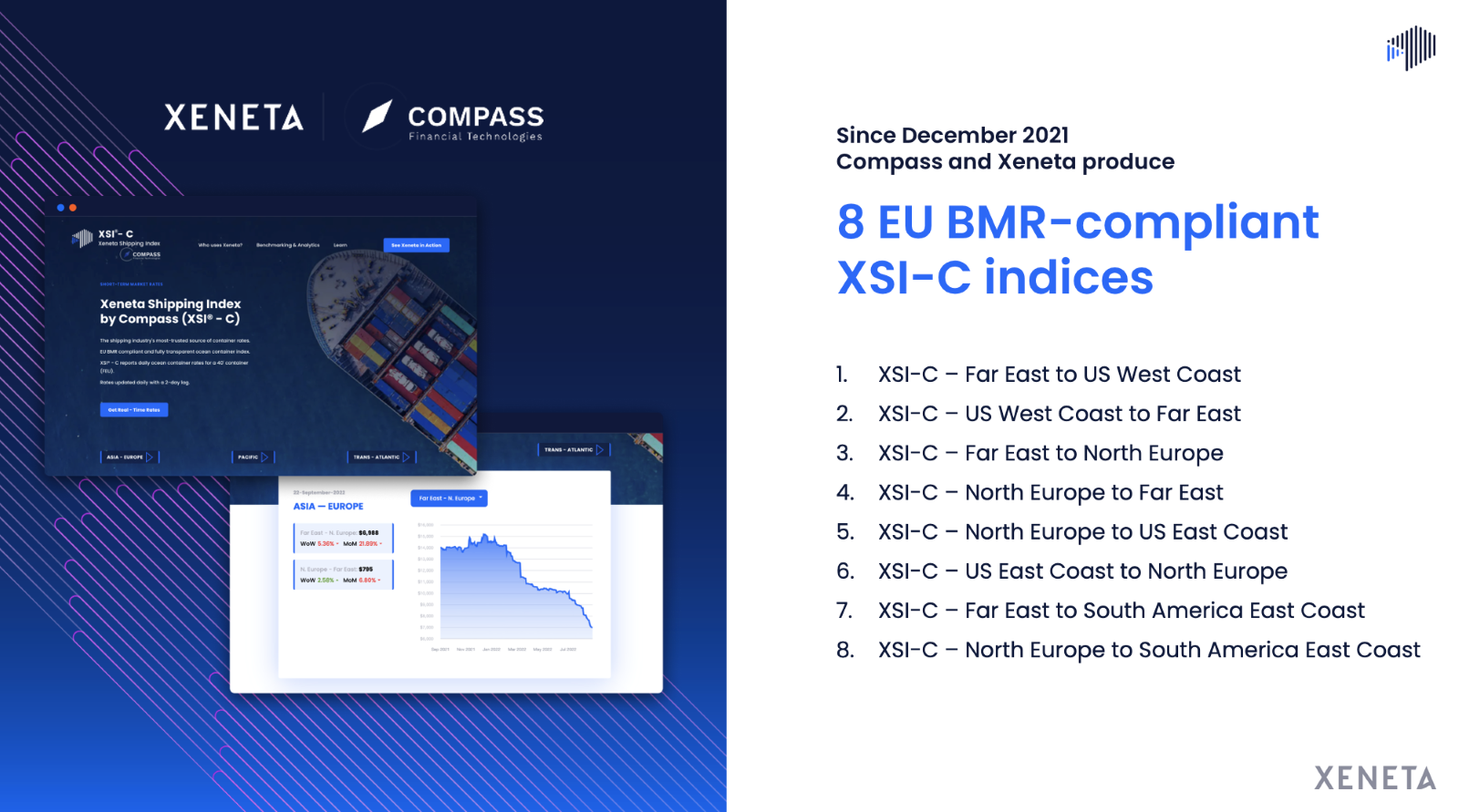

With Compass as our partner, our best eight lanes are EU Benchmark Regulation compliant and offer all our customers the opportunity to manage their ocean freight price risk as effectively as their treasury has been dealing with interest rates and foreign exchange risks.

Xeneta sits in a universe of other indices out there. One of the main attractions for our customers is that they already benchmark with Xeneta internally. It makes sense for them to contract with Xeneta data externally as well.

Many of our customers are naturally asking for XSI indexing, as a few carriers now also offer XSI-based index contracts.

More and more customers, irrespective of their business size, are coming around to index-based contracts as they look to save time. The largest customers, with hundreds or thousands of TEUs, cannot contract on the spot market with exposure to a floating price, as it’s a lot of work for them. Medium-sized shippers want to save time to run their business efficiently.

One of the advantages of Index contracting for the shippers is the ability to showcase their best judgment when questioned by management. With an index contract, everyone can confirm if they are paying higher or lower prices than the market.

As per a recent Xeneta customer survey, 25% of customers are considering fully incorporating index-linked contracts (ILC) with a clearly defined impact on the selection process.

Want to learn more?

Watch the latest monthly 'State of the Market Webinar' to stay on top of the latest market developments and learn how changing market conditions might affect your contract negotiations.

Missed the LIVE session? Sign up to get the webinar recording.