The Transatlantic fronthaul trade lane from North Europe to the US East Coast (USEC) was steady and ‘dull’ for decades before suddenly becoming the ‘poster boy’ of the container freight market in 2022, defying gravity with elevated rates for a long time after the rest of the market had crumbled.

It now finds itself in a spot rate meltdown, with the monthly average for a 40-foot standard container (FEU) crashing from USD 5,298 excluding Terminal Handling Charges (THC) in January to just USD 809 on average in August. That is a whopping fall of 85% and a serious loss-maker for carriers. Taking out THC narrows in on the ocean freight rate, which by mid-August was priced at almost the same level.

Shippers in the driving seat

Shippers on the trade are taking full advantage of this new reality, regaining the upper hand after the 2021-2022 pandemic period delivered dramatically high freight rates. Xeneta data shows the strongest are now paying less than USD 475 per FEU for spot business, which is an all-time low.

Our data also shows that the number of long-term contracts coming into force in 2023 is significantly down on past years, indicating that shippers are clearly not happy with the rates on offer nor being drawn into the kind of closer relationship carriers are seeking.

However, at USD 2,000 per FEU (excluding THC), North Europe to USEC long-term rates are still 2.5 times above spot levels, meaning this is the only fronthaul trade where long-term business remains above short-term rates; all other key trades have normalized in this respect.

What is behind the spot-rate collapse?

Volumes Tank

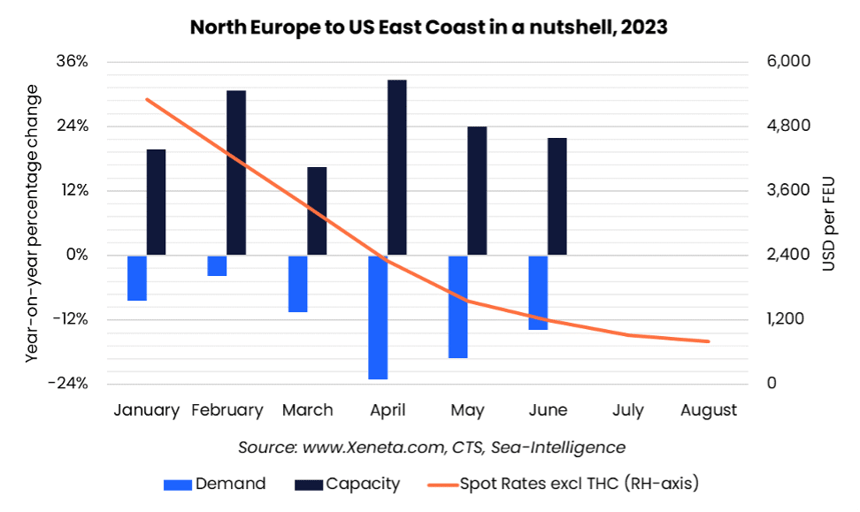

Firstly, demand is just not there. Transport volumes on the trade were down by 13.6% in the first half versus last year (source: CTS), with April alone scoring a 23% year-on-year fall. This is clearly visible in Xeneta data showing a spot-market slide from USD 3,875 per FEU at the end of March to USD 2,450 per FEU by 1 May.

The second quarter was worse than the first, and looking ahead Xeneta expects demand to fall short of 2022 during every month in the second half as well.

Capacity Sinkhole

Secondly, carriers have used this trade lane as a ‘parking lot’ for excess capacity not deployed on other corridors. Data from Sea-Intelligence indicates that capacity on the North Europe to North America East Coast trade rose by 23.6% in the first half versus 2022 (and by more than 30% just in February and April).

This leaves shippers wondering how much longer they should wait for carriers to start offering long-term rates that mirror underlying market conditions – in other words, much lower than today.

Pre-pandemic contract levels were hovering at USD 1,300 to USD 1,400 per FEU (excluding THC), with very few dollars separating them from spot rates. Obviously, the two contracts are very different.

Carriers, for their part, can see as clearly as ever the impact of a fundamentally weak trade resulting in spot-rate warfare. Those selling space at the current level are bleeding cash for every box they bring on board. Hence keeping cosy with key shippers is essential, but everything has its price.

Want to learn more?

Contact us to learn how Xeneta can help you prepare for this upcoming tender season and supplier/buyer negotiations. Gain the upper hand with actionable real-time ocean and air freight rate and capacity data.