Spot rates from the Far East to the Mediterranean, a trade heavily affected by the Red Sea crisis, took another step upwards in mid-January, rising by USD 1 630 per FEU between 14 and 18 January.

This leaves the average spot rate at USD 6 050 per FEU and 157% higher than a month ago.

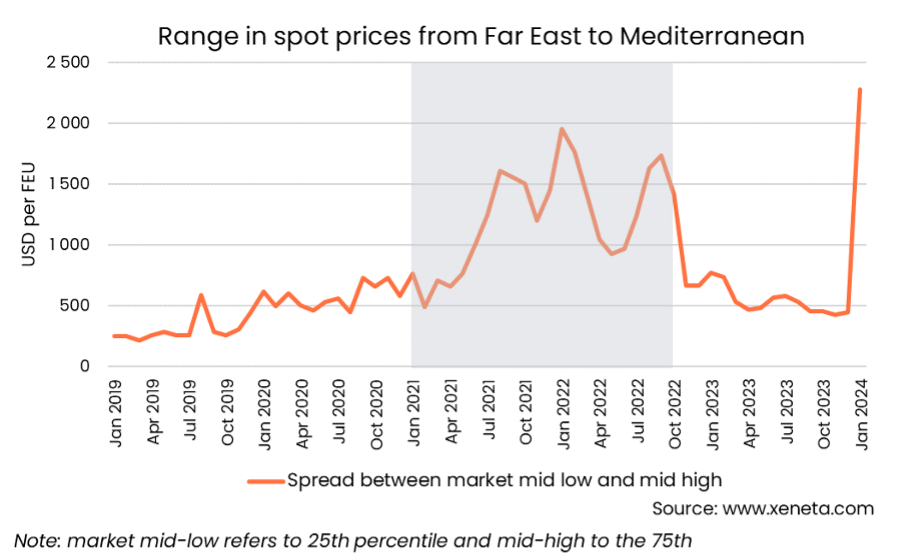

However, the picture is more nuanced, with the spread in the rates being paid by shippers raising to record levels. Despite today’s spot rates on this trade still being far below where they peaked in 2022, the difference between what shippers on the mid-low (25th percentile) are paying compared to those on the mid-high (75th percentile) has never been higher.

On 15 January the mid-low rate stood at USD 4 175 per FEU compared to a mid-high rate of USD 6 910 per FEU.

The USD 2 750 per FEU difference between these two rates is five times what the mid low to mid high spread was at the end of December 2023, and higher than it has ever been before. Though the spread has come down a little since then, between 1 and 18 January it has averaged USD 2 215 per FEU.

Even when spot rates on this trade peaked in March 2022 at USD 14 000 per FEU, the spread between the mid-low and mid-high rates was just under USD 1 500 per FEU.

The speed at which spot rates have increased, and the spread between the mid-low and mid-high, illustrates the turmoil faced by shippers. It also demonstrates how quickly the market has shifted from being plagued by overcapacity and carriers having extra ships on their hands, to capacity suddenly being in short supply through increased transit times and carriers having to find available ships to fill the holes from delayed repositioning.

In contrast, the increase in rates during the Covid pandemic in 2021 and 2022 was much more gradual, as it took months for congestion to build up on the US West Coast to such an extent that it impacted global container shipping capacity.

Emily Stausbøll, Xeneta Analyst, said: “Rates have not yet hit anywhere near the levels we saw during Covid-19, but the sudden nature of the Red Sea crisis has brought delays and disruption much quicker than the early months of the pandemic. That means we have also seen a much more rapid increase in rates.”

Other trades into and out of Europe also posting record spreads

The range in rates shippers are paying on the spot market has also jumped up on other major trades that rely on the Suez Canal. Between the Far East and North Europe, the average spot rate has increased by 181% from mid-December to USD 4 640 per FEU. Here, the spread between mid-low and mid-high rates has averaged USD 1 730 per FEU in January 2024.

Between the Far East and the US East Coast, affected not only by the Red Sea crisis, but also the drought in the Panama Canal, the spread has increased eightfold since the end of December, rising to USD 2 650 per FEU between mid-low and mid-high rates. Despite the mid-low to mid-high spread being higher now than on the trades into Europe, it remains far below its pandemic highs, which hit USD 7 450 per FEU in January 2022.

Backhaul trades are also seeing increasing spot rates and spreads, though not at the scale of fronthaul trades into Europe. Shippers on the backhaul trades are not facing the same capacity crunch, with carriers under increasing pressure to get vessels back to the Far East before Lunar New Year.

Two different markets

In a situation where the spread in spot rates on a given trade widens, shippers must look beyond the market average. Carriers and freight forwarders are pricing differently on a given shippers’ needs, with two distinct groups forming.

Many of the shippers securing rates at the lower end of the scale are doing so after their valid long term contracts have been suspended and their supplier has pushed them to the spot market. Though their spend is still going up, they are not rising to the same extent as spot rates for shippers having to rely on FAK rates.

While some shippers are still able to keep shipping on agreed contracts, only some of the largest shippers are having success at avoiding extra surcharges being imposed by their suppliers.

However, shippers should beware of chasing the lowest market rates. The capacity crunch means carriers may have to pick and choose what containers to put on board a ship if it is full and will prioritize the most valuable customers and those paying the highest rates.

It should also be noted that Xeneta benchmarked rates include all surcharges considered mandatory charges, with many shippers being forced to accept these on top of previously contracted rates. On top of these, some carriers are adding extra charges to guarantee space and equipment, these are not included in Xeneta rates.

Want more?

Download the 4 Steps Shippers Can Take Now’ providing a range of advice and insight to help navigate the ongoing crisis, such as support for internal meetings with CFOs, preparing to use more air freight and understanding the risks to your supply chain here.