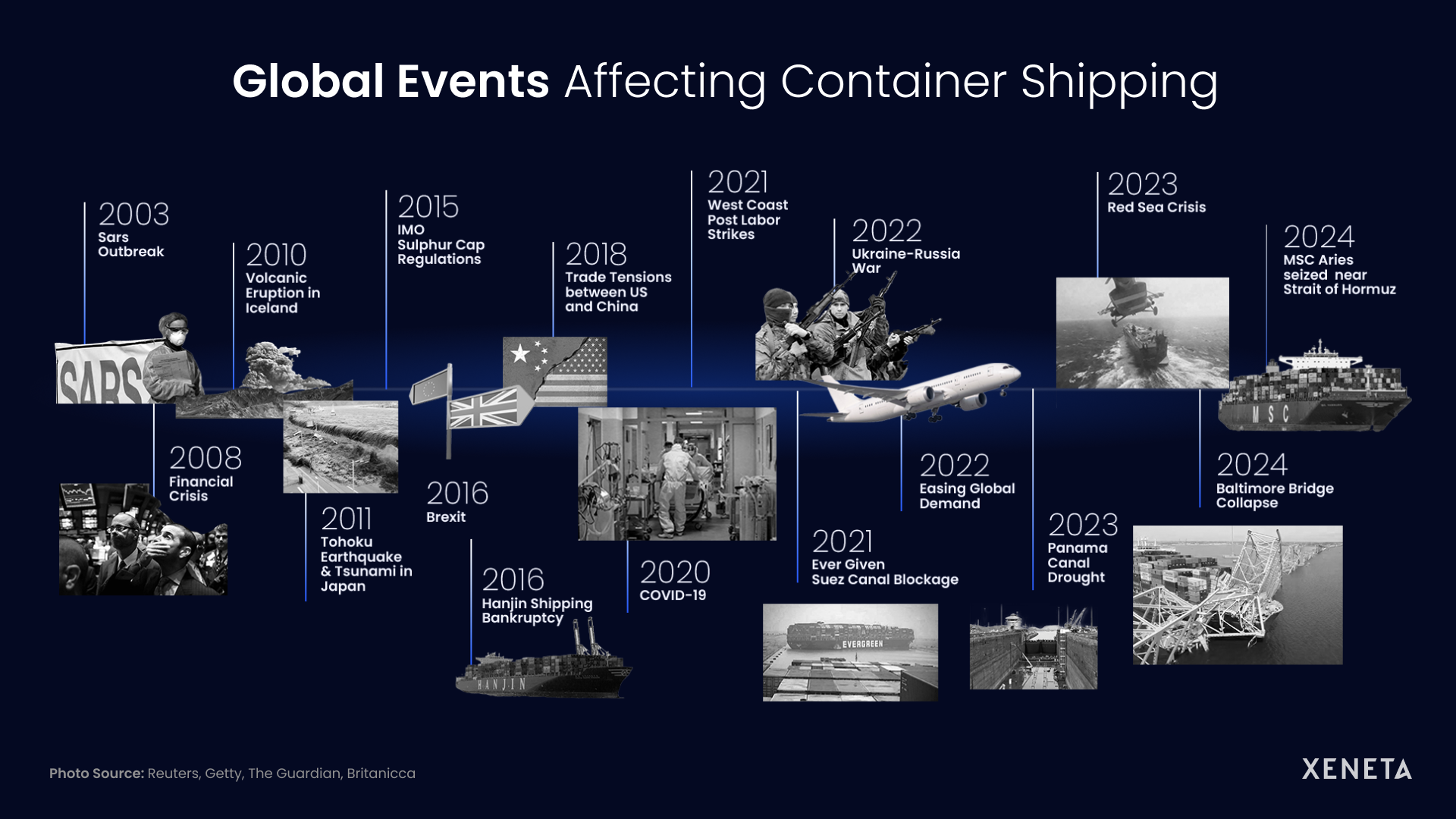

Global events are affecting container shipping – and these black swans are occurring ever more frequently in recent (as well as coming) years. Geopolitics, natural disasters and the recent incident in Baltimore; businesses face the daunting task of managing risk in their freight procurement strategies through them all.

Central to the discussion is the delicate balance between predictability, reliability, and flexibility. While long-term contracts can offer a certain level of stability in supply chain operations, they also come with inherent risks.

These risks include:

-

Being locked into fixed rates for an extended period, or contracted to mirror market rate fluctuations. For instance, if you’re a shipper and you’ve agreed fixed rates, you could be exposed to higher rates should rates fall during the contracted period. On the other hand, if you choose to agree index linked rates, you have to balance the risk of ‘getting the service level you want under a long-term contract’ – while not losing out on a rate fall – BUT also exposing yourself as a shipper to higher costs if rates go up. Carriers engage with index linked contracts because they prefer to lock in the volumes, and not expose themselves to losing out on higher rates.

-

Little to no flexibility for changing business operational requirements and strategies – such as fluctuations in demand, changes in where materials are being sourced and manufactured, or shifts in market dynamics.

-

Being tied to a specific carrier or supplier for an extended period reduces options should the transportation providers reliability change – this can look like additional surcharges, service delays, or financial instability.

-

Limited mechanisms to renegotiate rates or take advantage of cost-saving opportunities that arise in the market during the contract period – this is especially true if the fixed-rate contract has no renegotiation clause.

Another factor is knowing when to sign longer-term contracts.

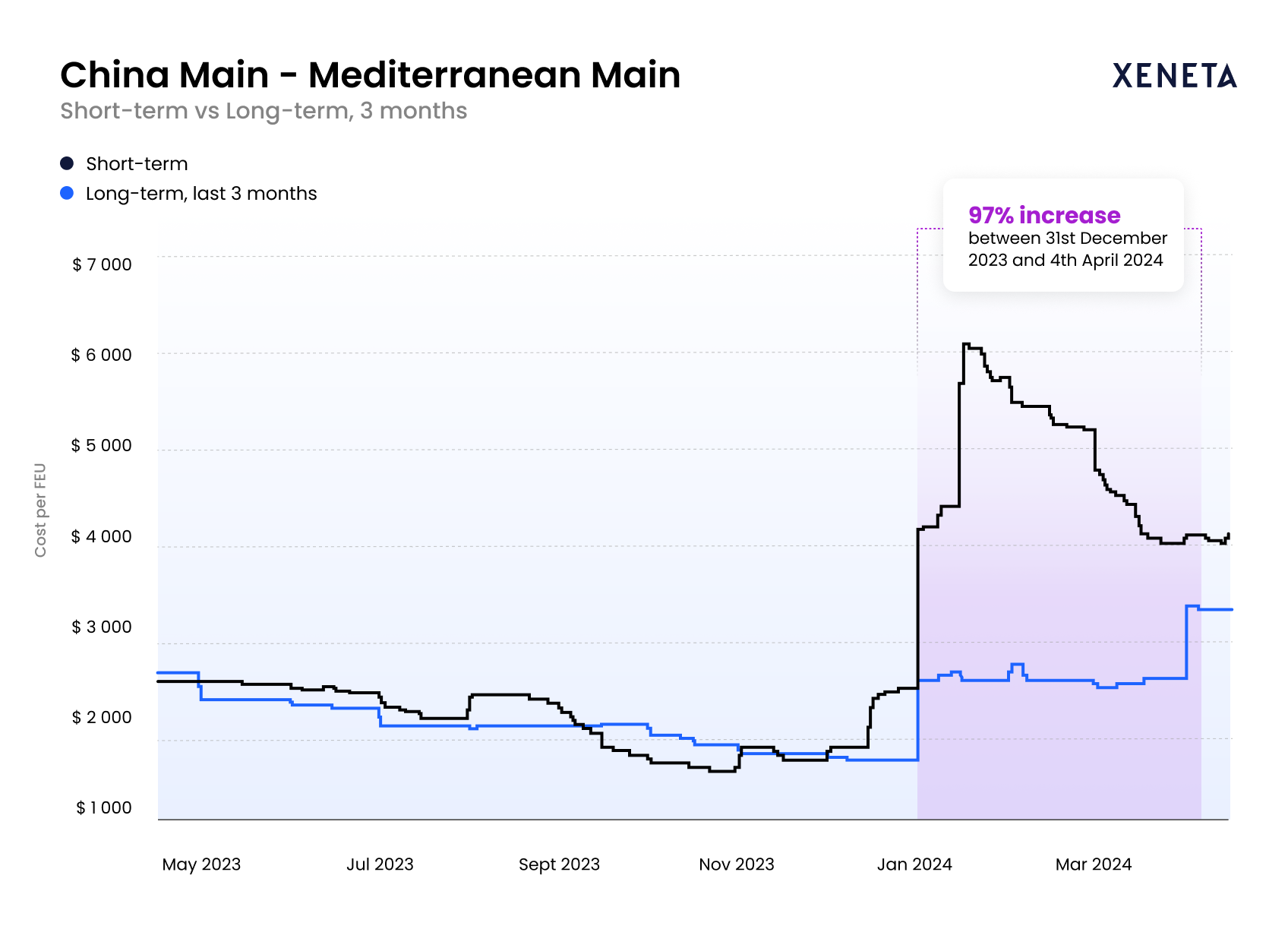

If you were to look back to Q3 and Q4 2023, average spot rates were considerably lower than they are today, which created more favorable conditions for shippers when negotiating new long-term agreements. And yet, some chose to delay signing, believing that the market would continue to soften in their favor. Fast forward just seven weeks and short-term rates jumped 243% on the Far East to Mediterranean trade lane following escalation in the Red Sea – with surcharges imposed on long-term rates.

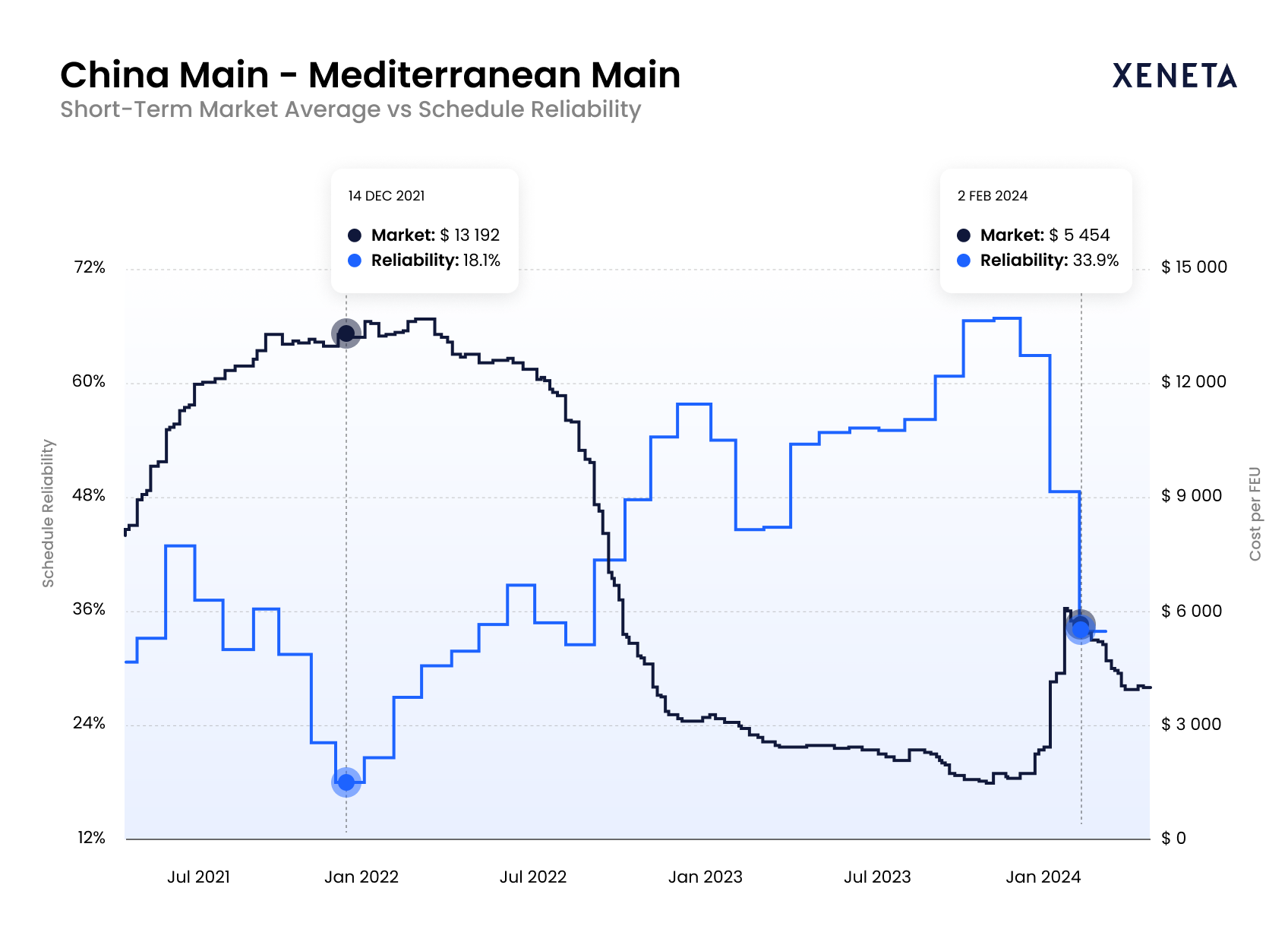

Even if your cargo wasn’t directly impacted by the Red Sea, the rate increase on the Far East to Mediterranean corridor should have been a valued indictor that rates were about to spike on other lanes too. Just look at China Main to Mediterranean. While long-term rates react with a few weeks delay, those monitoring spot rates would have been able to see pressure building in rate movement.

Risk management is also a question of timing. You may want to avoid tendering on all the trades where you need transportation at the same time. Prioritizing your transportation needs by trade lane will also benefit you at large as a shipper, when negotiating and allocation for discussions.

For shippers unable to pause new freight shipments during this time, they were given a choice: move to the spot market temporarily at elevated rates, negotiate shorter term contracts (often at a higher cost) and/or reduce number of boxes being shipped on a particular trade lane until the market softened again, or sign longer-term contracts at a comparably lower, but still increased, rate – hoping this would pay off if rates were to keep increasing.

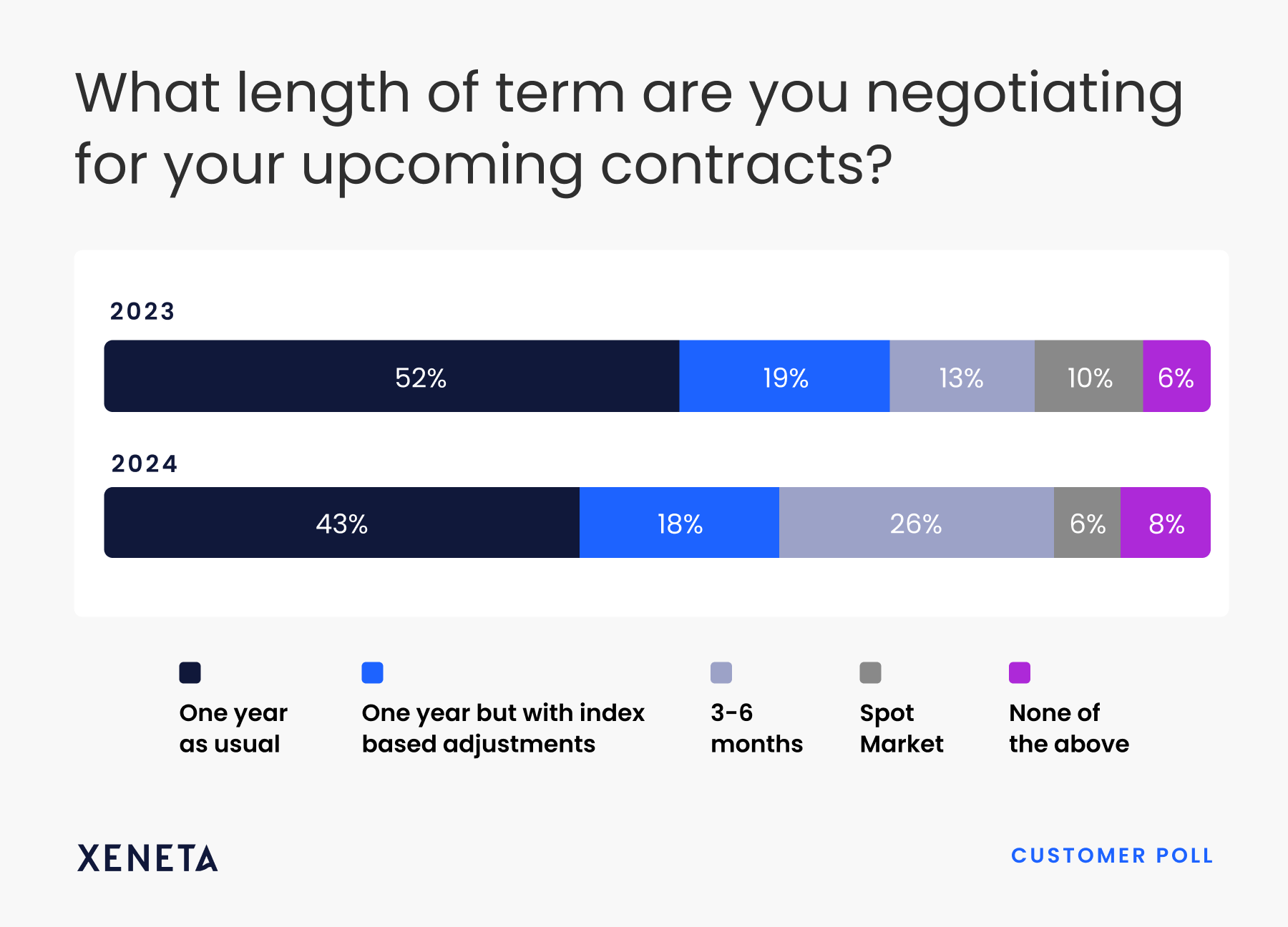

The below data was pulled from two Xeneta customer surveys conducted a year apart (February 2023 and February 2024). Both BCOs and Freight Forwarders were surveyed – each with unique supply needs and independent negotiation requirements.

While 12-month contracts remain the most popular at 43%, this is a decrease from 52% in 2023. Conversely, 3–6-month contracts have grown from 13% to 26% during the same period.

When asked why we’re seeing this change in behavior, Peter Sand, Xeneta Chief Analyst explains:

“This is all about risk management. When you are unsure of the market direction for the present and near-term future, you avoid locking yourself into long duration contracts, because you don’t want to be caught paying too much if the market comes down. This is especially true if you don’t have a clause included in the contract that allows you to renegotiate in the case of falling prices. Carriers on the other hand will likely push to include renegotiation clauses to ensure the opposite in the event rates go up, they don’t want a lower paying contract.”

More than costs.

Every shipper procures freight to serve a bigger need – to ensure the materials and goods they need to run their business are getting to the right places, in the right amounts and on time.

12-month-term contracts remain the preferred choice because of their predictability and cost effectiveness when compared to short-term rates. We don’t predict that this will change any time soon but there is a clear shift towards the short-term market with some shippers.

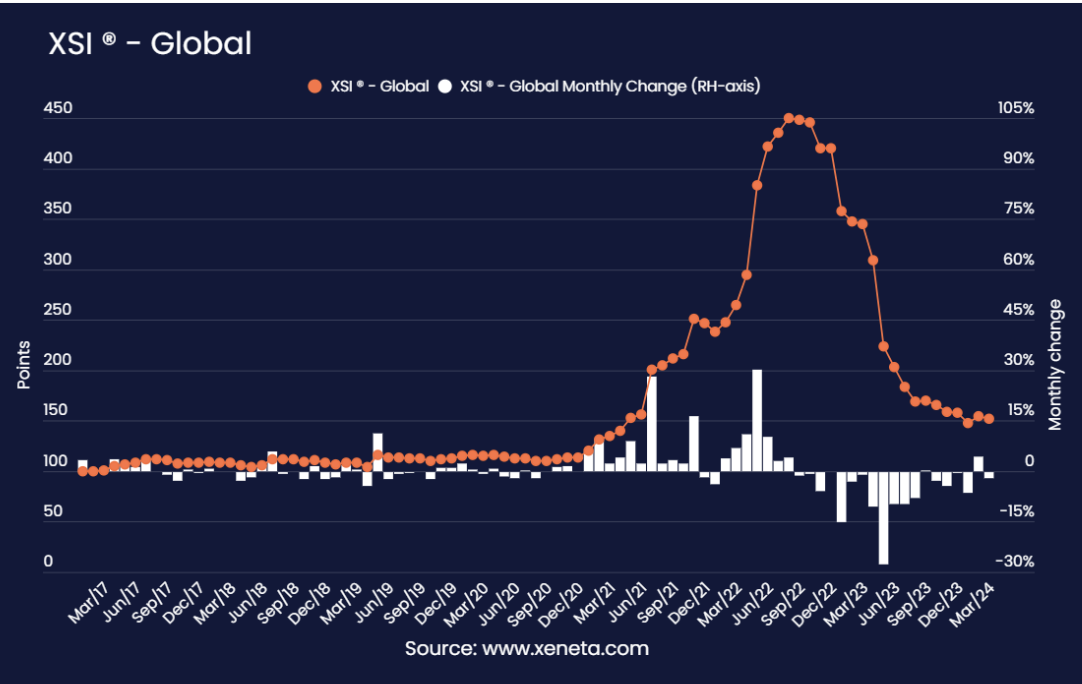

The behaviors we’re currently witnessing towards contract negotiations appear to a symptom of the times. If you look at the Xeneta XSI®, the absence of significant movement in March reflects the low number of new contracts entering validity in this period. This is partly explained by it being the final month in the quarter, but also due to shippers choosing to delay signing new long-term contracts.

The spot market is currently considerably more expensive than the long-term market, but it is continuing to soften, and shippers are doing what they can to avoid locking themselves into high rates on long term contract (though they will face an uptick from their previous contract).

For many, shorter-term contracts of 3-6 months are a business necessity, not a preference. They can offer temporary relief by enabling shippers to secure their supply chains by making sure their cargo makes it onto the ship – albeit at a significantly higher cost per TEU than a 12-month contract would provide – without having to commit to 12-months of elevated costs that they are potentially unable to pass on to customers.

Rather than relying solely on the duration of contracts as a risk management tool, shippers are encouraged to consider other variables such as timing of tendering and index-based pricing measures. By carefully assessing the essential trade lanes for their business and strategically adjusting the length and terms of contracts, shippers can mitigate risks and seize opportunities in a dynamic market landscape.

As you know, long- and short-term markets behave very differently, and while your preferred trade lanes might not be directly impacted by a global event, they can still experience a ripple effect. Take the Transpacific trade corridor for example. Despite not transiting the Suez Canal, rates still escalated following the Red Sea crisis – resulting in a 180% increase in the spot market since mid-December.

The ongoing conflict in the Red Sea/Gulf of Aden – as well as a strong demand for e-commerce out of China – also produced a positive spill over modal shift in favor of air cargo. This saw the global air cargo market experience its third double-digit year-on-year growth (+11%) in the first two months of 2024.

In other words, even if you only ever use one shipping lane or one primary channel for your supply chain, using freight intelligence to understand how different lanes or transportation modes are moving is good business sense. It brings vital market context to your decision-making and provides alternatives when your go-to option is out of action (droughts, geopolitics, bridge collapse...), proving unreliable (schedule reliability, delays...), too expensive (aggressive surcharges) or you need to negotiate more advantageous spot-rates.

On the other side of the conversation, carriers need to consider offering customers something in exchange for signing a longer-term contract that’s beyond competitive rates. A cheaper rate doesn’t count for much if your customers’ cargo is always late or doesn’t arrive at all. And sometimes, it’s not cheaper at all.

While shippers may have been prepared to pay more for faster transit times, recent years have shown that as schedule reliability has gone down due to market volatility, the spot market has responded with higher rates. This means that on occasion, shippers have been faced with USD 13,192 per FEU rates, while schedule reliability sat at just 18.1% (China Main to Mediterranean Main corridor, 14th December 2021). In the past 6 months alone (since 5th October 2023), shippers experienced a 241% increase in spot rates, contrasted with a 49% decrease in reliability.

Although this is an inherent dynamic of the market, selling a level of service that shippers will never get (2/10 ships arriving on time) may encourage shippers to vote with their feet, or change mode altogether – as we’ve seen with airfreight increases since the Red Sea Crisis.

Greed – a shipper’s worst enemy

The covid-19 pandemic, Red Sea crisis and Panama Canal droughts have underscored the importance of agility and adaptability in freight procurement. They have also highlighted the risk shippers take on when trying to “chase the final dollar”.

If we return to pre-Red Sea disruption in the first half of December 2023, those who waited too long to commit to a long-term contract, or were more reluctant to deviate from a more traditional procurement process, are now facing the consequences of abnormally high spot market rates – which will have had an impact on long-term contracts signed in January-March 2024.

.png?width=1696&height=1248&name=GRAPH3%20FEU%20(3).png)

As Peter Sand notes:

“The worst enemy for a shipper is their own greed (or a desire to get back at carriers extremely high rate-ask, following the crazy covid-years). What we saw six months ago was quite low (spot?) rates and long-term contracts at around pre-pandemic levels. For the risk adverse, it made sense to sign a multi-year contract at that time, but many continued to wait for prices to continue trending down before signing, and now we’re in the situation we’re in.”

The moral of the story? Don’t go chasing the final dollar. Instead, balance the risk of higher costs against the value of striving for the lowest rates possible.”

Having the option to adjust the length of contracts, or delay the signing of longer-term contracts, is a welcome interim measure among shippers and freight forwarders who seek strategic solutions to help navigate ‘one of the most unpredictable years in recent times’. Or in the case of the Red Sea, for shippers who needed to pivot budget decisions after missing out on preferable rates.

It’s not going to work for every shipper or every shipment, but where possible, leveraging data-driven insights to better understand when and what length of contract to sign – and considering predictability and reliability of services as important as cost – can restore business resilience at a time of accumulative market uncertainty.

Having the tools to better assess what supply chain disruptions might come your way – and having contingency plans in the drawer ready to deploy – is equally as vital. This goes for the carriers, carrier CFOs as well as global shippers.

Fortunately, the Xeneta data and intelligence platform provides transparency and visibility into market dynamics. This enables shippers to navigate the modern-day complexities of procurement with confidence and clarity – giving a more accurate view of how you benchmark against your competitors, reducing financial exposure and identifying opportunities in real-time.

%201.png)